The Secret to Building Trust With Clients

Trust is a critical component of any relationship, and this is especially true in the financial advisory arena.

Our purpose-driven software and behavioral experts work together to meet your business needs best.

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

Do you have the right clients? This is a very topical issue for many financial planners, particularly those who have already built a business to a reasonable level. Actually, it is as important as the client selecting the right advisor.

In the end there must be a mutual relationship with the parties comfortable with each other. The relationship cannot start out (but it often does) with the client simply having dollars in the bank account and some financial planning needs, and on the other side the client believing the advisor has the skills and the necessary integrity. In fact, these are all assumed to get to the point of the first meeting.

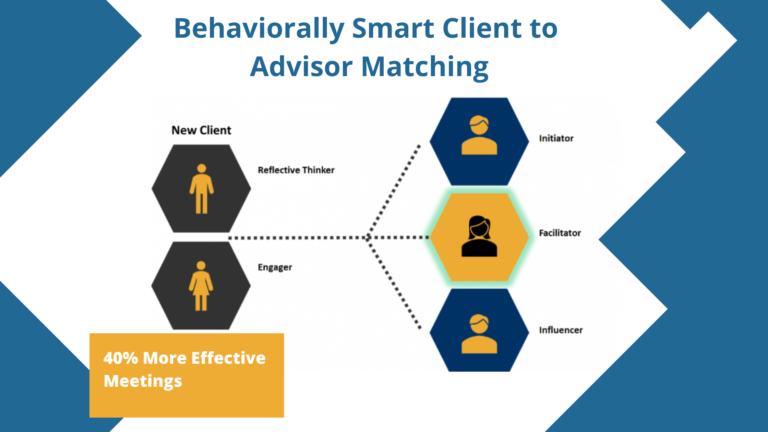

Our business is all about looking at the behavioral style of the clients and also the advisors. So, not unexpectedly, the approach we take is to match clients and advisors based on their behavioral style. This is very much an inside-out approach, however all great relationships start below the surface. Human behavior is at the core. The great thing is that the Financial DNA system measures natural behavior which means we can reliably predict the behavioral style of the advisor and client in terms of how that person will always be, particularly under pressure. I would say that our approach must still be blended with a number of other more traditional selection factors such as client size, service style, values, expertise, etc. that are mentioned in Bob’s article.

To help the advisor we have developed an Advisor/Client Compatibility Matrix. The matrix is a one-page grid which matches profile styles based on the level of modification that will be required between advisor and client. To be clear, it does not say you cannot work with someone, but it does say who will be easier (green box on the matrix) based on less behavioral modification – this is where communication, chemistry, etc. is likely to be higher. Hence, this is where the relationship will be naturally more sustainable over a longer period with less stress. So if you are an advisor wanting to segment your client base a reliable starting point is now provided.

I do not necessarily advocate that you fire those clients who will require more behavioral modification (red box on the matrix). This will be a warning sign that you have to put more work into adapting to maintain the relationship. Although what you may wish to do is allocate these clients to a partner who is different to you or hire someone who is different to you to provide a complementary style. Many advisors have found this approach to be foundational for selecting their next hire. Or in how they deliver client service with a team-based approach. Hence, the planner may get the relationship started and then another person on the team steps in.

Are you interested in the value of your practice? Importantly for advisors, this approach also helps you to identify to whom you sell your business. The sustainability of the relationships and hence the revenue is critical to business value.

Learn More About the Benefits of the Financial DNA System

Trust is a critical component of any relationship, and this is especially true in the financial advisory arena.

We’d all like to think that rationality rules our financial decisions, but the fact is, we’re only human.

We’ve prepared a behavioral cheat sheet, collected from the works of DNA Behavior’s executive chairman, Hugh Massie!