1 min read

How Merit Financial Advisors Built an Exceptional Hiring and M&A Process

About Merit Financial Advisors Merit Financial Advisors uses the DNA Web App to find the right talent, enhance team dynamics, and acquire firms that...

Our purpose-driven software and behavioral experts work together to meet your business needs best.

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

When it came to building a client-centered approach to wealth management, Arete Bank turned to DNA Behavior for the human data they needed.

Arete, a renowned financial institution in the U.S., wanted to stand out in their industry by providing hyper-personalized client services. That meant getting access to behavioral data that could bolster the effectiveness of their UHNW advisory team. So, they consulted DNA Behavior to find a solution that not only did that, but also helped refine the advisor decision-making process. This case study looks at how they utilized the DNA Web App to restructure and revolutionize their wealth management services.

The Implementation of Behavioral Analytics

Under the leadership of Mary McFarlane, head of the Wealth Management Division, the bank embarked on a journey of discovery with DNA Behavior's suite of tools. The implementation process was methodical and detailed so they could garner as much useful information as possible.

Behavioral Variability Program

Advisors completed the DNA Natural Behavior Discovery Process, gaining insights into their work talents and financial behavior.

Interactive Training

Advisors engaged in practical case studies, learning to identify key decisions for client scenarios and understanding how their behavioral biases impacted their perceptions.

Decision-Making Analysis

The training and subsequent analysis revealed a 50% variance in decisions, highlighting the need for a structured, behavior-driven advisory approach.

Continuous Improvement Strategy

A structured approach to training and the deployment of behavioral tools ensured continuous improvement in the advisory process.

Arete's Use of Key App Features

The DNA Behavior platform offered several key features that played a pivotal role in transforming Arete Bank's advisory services.

DNA Natural Behavior Discovery Process: A 10-minute assessment unveiled the intrinsic behavioral patterns of advisors, enhancing self-awareness.

Work Talent Insights: These insights offered a deeper understanding of advisors' work-related strengths and struggles.

Financial Behavior Insights: These unique financial insights enabled advisors to comprehend their financial decision-making tendencies and make improvements.

Factor and Sub-Factor Insights: This more granular level of insights provided a detailed analysis of behavioral aspects affecting advisors' interactions with clients.

Behavioral Biases: Biases were identified and addressed in each advisor's decision-making process.

Tags for Client Identification: By tagging and sorting clients by behavioral traits, it facilitated the organization of clients by an advisor.

Style Match: This tool enabled advisors to align their advisory style with individual client preferences.

Market Mood: Real-time market activity was paired with a client's market sentiments, aiding in the provision of highly relevant and tailored advice.

Data Export for Insights Analysis: Being able to download insights into a spreadsheet allowed for comprehensive analysis and application of behavioral insights.

Enhancing Engagement With AI Assistance

In addition to insights and features of the DNA Web App, Gene AI also played a role in transforming Arete Bank's delivery of wealth management services. This generative AI tool was instrumental in emotionally engaging employees and clients, fostering deeper connections, and enhancing the overall service experience. Gene AI's real-time assistance and guidance have made DNA Behavior's suite of tools more accessible and practical, further solidifying Arete Bank's commitment to a client-centered business model.

Tailoring Client Interactions

The main insights provided by the behavioral platform focus on understanding the talents and behavioral biases of advisors and how these influence client interactions. By comparing advisor and client styles, the bank could now tailor its approach to each client's unique needs. One significant challenge was overcoming the skepticism of experienced advisors, who initially trusted their intuition over behavioral data. However, the clear advantages of a data-driven strategy eventually won them over.

Metrics and Results: The Bottom Line

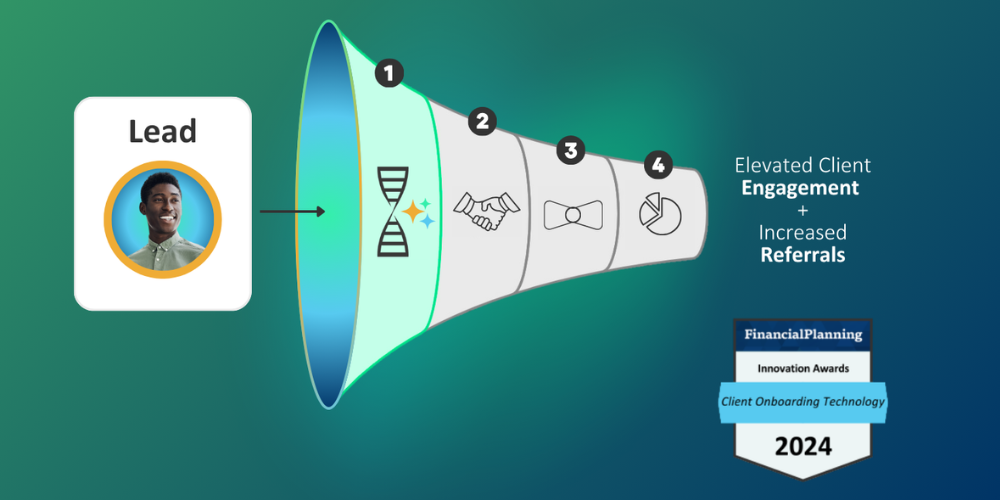

The introduction of DNA Behavior led to remarkable results.

Reduced Decision-Making Variability: Consistency in decision-making improved, reducing variability from 50% to 10%, indicating a more reliable advisory process.

Time Efficiency: They saved 2 hours per client per year, translating to 300,000 hours annually across 1,500 advisors.

Increased Client Referrals: More satisfied clients making referrals to the bank led to $300 million in new revenue and a substantial increase in the average base of referring clients.

Enhanced Client Trust: The adoption of behavioral coaching resulted in better quality advice, valued at an additional 150 bps (basis points) per client.

The Power of Early Adoption and Continuous Improvement

Mary McFarlane's strategy of starting with a select group of early adopters proved crucial. An initial set of participating advisors not only became advocates for the behavioral approach but also provided invaluable feedback to refine the process further.

Building A Client-Centered Future

DNA Behavior's journey with Arete Bank exemplifies our commitment to enhancing client-advisor relationships through deep behavioral insights. This case study demonstrates the transformative power of understanding client behaviors and adapting services to meet their unique needs. At DNA Behavior, we are dedicated to empowering financial institutions like Arete Bank to reach new heights in client satisfaction and service excellence.

*The name of the business featured in this article has been changed for privacy purposes, but the information presented is true and accurate for the actual company it represents.

1 min read

About Merit Financial Advisors Merit Financial Advisors uses the DNA Web App to find the right talent, enhance team dynamics, and acquire firms that...

Through its partnership with DNA Behavior, a Top 25 RIA firm transformed its custodian referral pipeline using Digital Scan’s predictive behavioral...

Maximum Impact Partners leverages the DNA Web App in their mission to develop some of the most effective sales teams in the financial services...