Digital Scan: Know Your Leads Before They Knock

AI-powered behavioral assessments give coaches the information they need to connect with people from day one.

Our purpose-driven software and behavioral experts work together to meet your business needs best.

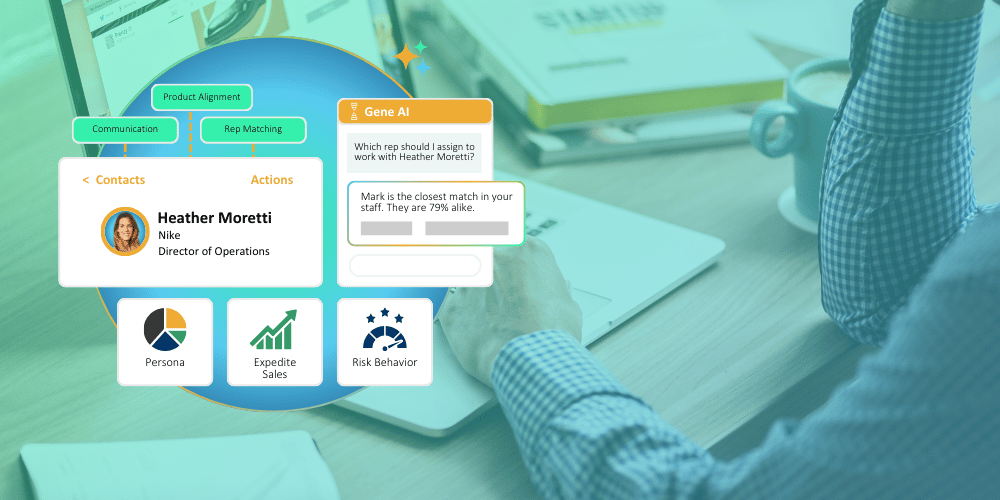

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

2 min read

Ryan Scott

:

April 08, 2025

We combine existing client behavioral and sales data with new Digital Scan results to give you a powerful decision-enhancing picture!

For years, enterprises have relied on behavioral assessments like DISC to support coaching and team-building efforts. But here’s the catch: those reports almost always end up in static PDFs—buried in email inboxes, hard drives, and folders. Powerful data...stuck.

So, when a large financial services firm came to DNA Behavior with 514 legacy DISC reports and a database of 22,000 clients, they asked a simple but game-changing question:

Can we turn this into something usable—for sales, for leadership, for growth?

With Digital Scan, the answer is yes.

This enterprise firm had spent years collecting behavioral data from advisors, plus decades of first-party client information. But none of it was working together. Their C-suite wanted insight, specifically:

They had two core business lines: wealth and insurance. But they had no way to behavioralize their customer journey—until Digital Scan came in.

Here’s how we flipped the entire behavioral data model in just a few strategic moves:

🔁 Step 1: Reclaiming DISC Data

We ran all 514 legacy advisor DISC reports through Digital Scan, translating them into DNA Behavior-style profiles—creating behavioral continuity without retesting anyone.

👥 Step 2: Scanning the Client Base

Using names, job titles, and a few basic inputs, we scanned all 22,000 client records. This provided predicted behavioral personas for every single client: Take Charge, People, Patient, or Planned.

.png?width=800&height=453&name=website-Digital%20Scan%20for%20EVENTS%20(2).png)

📊 Step 3: Tying Behavior to Revenue

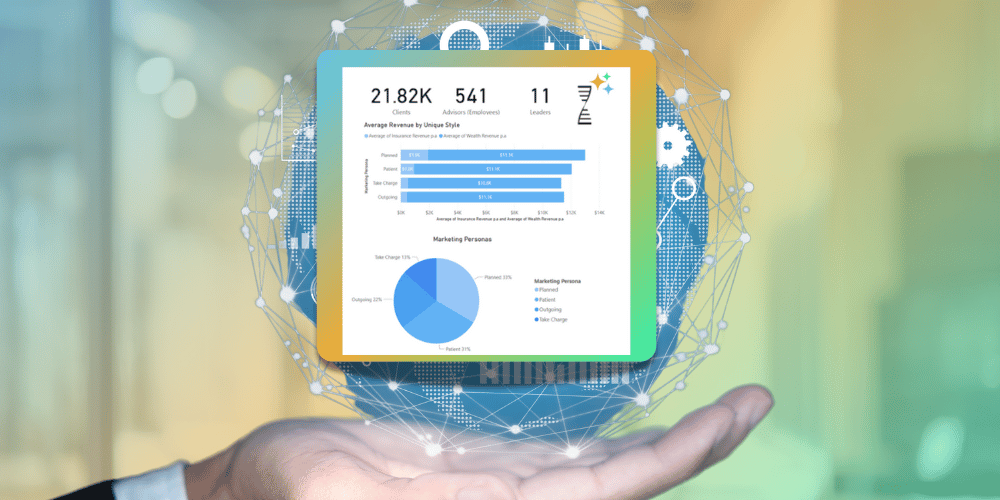

Next, we used an internal data engineer at DNA Behavior to layer in the firm’s own sales data—mapping revenue and product type (wealth or insurance) to each behavioral segment and plotting this onto an interactive Power BI Dashboard.

📈 Step 4: Building the Dashboard

We delivered an enterprise-grade dashboard visualizing:

Result: A real-time, executive-ready dashboard that turned behavior into strategy

What stood out? The firm's client base—largely blue-collar, long-tenured professionals—showed strong Patient and Planned behavioral patterns.

And guess what? These same clients were disproportionately buying insurance products.

That insight wasn’t just validating—it was transformational. The firm could now:

What was once a sea of static documents became a living, breathing behavioral map of the enterprise—integrated, interactive, and accessible to every decision-maker.

No more disconnected assessments. No more blind spots. Just behavioral science with business teeth.

AI-powered behavioral assessments give coaches the information they need to connect with people from day one.

Today, we're breaking down what webhooks are, how we use them, and how we envision the DNA community loving them.