1 min read

How Merit Financial Advisors Built an Exceptional Hiring and M&A Process

About Merit Financial Advisors Merit Financial Advisors uses the DNA Web App to find the right talent, enhance team dynamics, and acquire firms that...

Our purpose-driven software and behavioral experts work together to meet your business needs best.

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

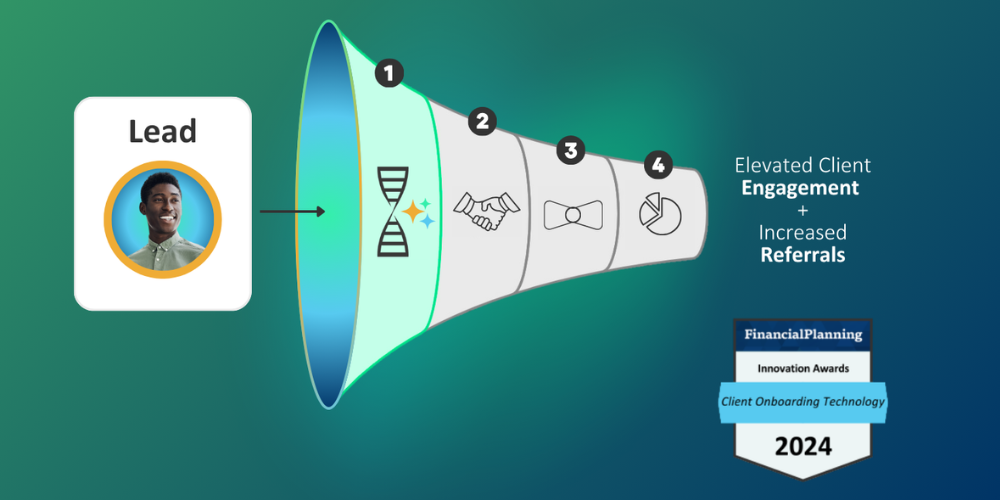

Through its partnership with DNA Behavior, a Top 25 RIA firm transformed its custodian referral pipeline using Digital Scan’s predictive behavioral insights.

By leveraging AI-based behavioral matching, the firm achieved higher conversion, retention, and satisfaction, turning each referral into a uniquely personalized client journey from day one.

Referrals from top-tier custodian referral programs represent a significant growth channel for independent Registered Investment Advisor (RIA) firms. For a Top 25 RIA firm, these referrals are both an opportunity and a challenge.

Each referral introduces the potential for a lifelong client relationship. And, matching clients to the right advisor from day one is one of the best ways to foster a relationship that will thrive.

To address this, the firm adopted DNA Behavior’s Digital Scan, a behavioral AI tool that predicts an individual’s financial behavior and communication style using only basic inputs such as name, job title, and company.

While the custodian referral program delivers a steady stream of qualified leads, the firm’s leadership observed three recurring challenges:

The firm sought a solution that could blend seamlessly into its referral intake process, one that combined predictive accuracy with the immediacy needed for first impression success.

Digital Scan instantly uncovers behavioral traits using AI, powered by DNA Behavior’s proprietary database of millions of real-world behavioral insights.

Here’s how the firm integrated Digital Scan into its top-tier custodian referral workflow:

Since adopting Digital Scan, the firm has seen measurable improvements in engagement metrics and conversion rates across its referral channel.

Quantitative Outcomes:

*aggregated across 12 months of program data

Qualitative Outcomes:

The Digital Scan engine operates within a secure Microsoft Azure cloud environment, using multiple predictive layers:

This approach requires no effort on the part of your client or prospect, giving you a head start at personalizing their experience. Digital Scan provides instant behavioral data at scale with over 70% predictive accuracy. It's a great way to enhance client onboarding! At a later stage, you can invite clients to take the full 46-question Natural Behavior Discovery to build an even richer behavioral profile with 97.1% accuracy.

By embedding behavioral intelligence into its custodian referral process, the RIA firm turned what was once a manual, intuition-based step into a data-driven advisor client matching system.

The results reach beyond referral conversion:

A senior partner summarized it this way:

“Before Digital Scan, a referral was just a name. Now, it’s a relationship blueprint before we even make the first call.”

The success of Digital Scan within the top-tier custodian referral program has prompted expansion across other client acquisition channels. The firm now uses Digital Scan insights to:

For DNA Behavior, this case exemplifies how Digital Scan can enhance both client experience and advisor performance, bridging psychology and data science to create measurable business impact.

Book a Call with one of our experts to see how easy it is to add a layer of behavioral intelligence to your CRM!

1 min read

About Merit Financial Advisors Merit Financial Advisors uses the DNA Web App to find the right talent, enhance team dynamics, and acquire firms that...

At DNA Behavior, we constantly innovate to deliver tools that empower advisors and clients to make better decisions. Our business—the business of...

We’d all like to think that rationality rules our financial decisions, but the fact is, we’re only human.