Digital Scan Delivers Enterprise-Wide Intelligence for C-Suites

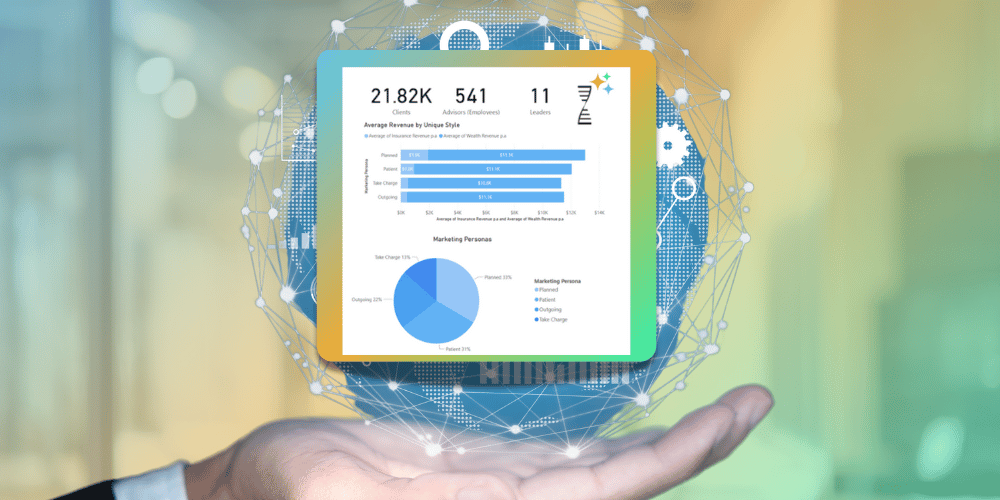

We combine existing client behavioral and sales data with new Digital Scan results to give you a powerful decision-enhancing picture!

Our purpose-driven software and behavioral experts work together to meet your business needs best.

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

2 min read

Ryan Scott

:

January 16, 2025

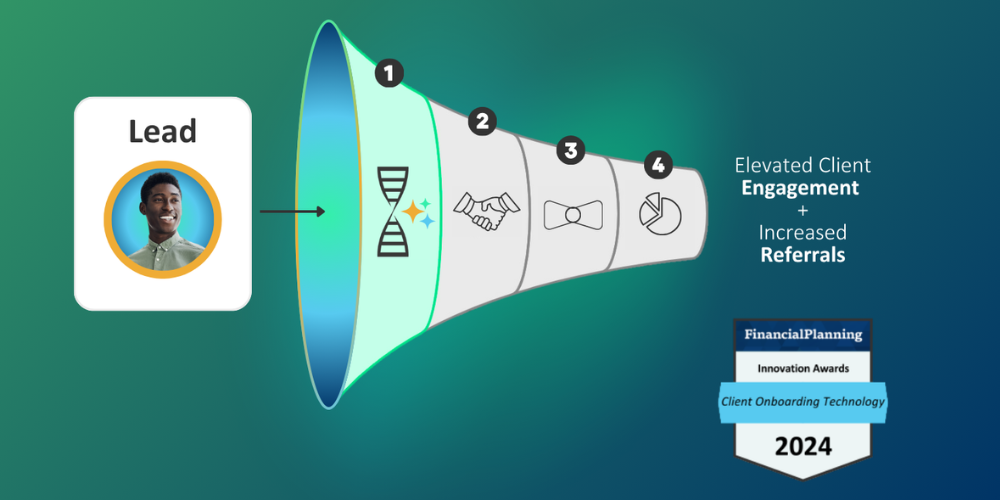

At DNA Behavior, we constantly innovate to deliver tools that empower advisors and clients to make better decisions. Our business—the business of understanding people—is not just about innovation for innovation's sake. It’s about uncovering the insights that define us and our clients and using those insights to drive meaningful conversations and relationships.

This latest update to the Financial Behavior Report was inspired by feedback from our valued user community. Your input (check out our public roadmap) plays a vital role in shaping the future of DNA Behavior. Let’s dive into the exciting updates that are now live!

1. Detailed Breakdown of Risk Propensity and Risk Tolerance

We’ve added a comprehensive analysis of two key risk behaviors:

Why It Matters:

These insights allow for deeper, more engaging discussions with your clients about their risk behaviors and financial behaviors. To see how these insights can help your business:

2. Percentile-Based Scoring

Each risk behavior is reported using two formats for clarity:

For example:

This dual approach helps you and your clients visualize their position among a larger population, sparking conversations about what makes them unique.

3. Natural Behavior Portfolio Risk Group

This section introduces personalized portfolio structures based on the client’s natural behaviors. Advisors can use these insights to:

It’s important to note that the Overall Portfolio Risk Group, ultimately used in the Financial Plan and Investment Policy Statement, may also reflect other factors, including financial goals and capacity. To foster these conversations with your clients, we have included the additional sections on pages 6 and 7.

4. Consideration Factors for Final Risk Group Determination

On pages 6 and 7, you’ll find two key sections designed to assist in refining the Overall Portfolio Risk Group:

By analyzing these elements, advisors and clients can collaboratively determine the most suitable portfolio strategy.

We combine existing client behavioral and sales data with new Digital Scan results to give you a powerful decision-enhancing picture!

No Profile? No Problem. Coaches can get instant behavioral insights without the need for a completed questionnaire.

Through its partnership with DNA Behavior, a Top 25 RIA firm transformed its custodian referral pipeline using Digital Scan’s predictive behavioral...