Personalizing High-Net-Worth Client Interactions

When it came to building a client-centered approach to wealth management, Arete Bank turned to DNA Behavior for the human data they needed.

Our purpose-driven software and behavioral experts work together to meet your business needs best.

Our app lets you toggle between insights most relevant to the employee or client experience.

Key behavioral insights can be integrated into your favorite web tools and custom applications.

Our behavioral experts can help you get the most out of our technology through training programs, customized workshops, and more.

Register for one of our online events to get focused guidance on the practical uses of our platform and have your questions answered.

Learn how we use psychometric measurement to accurately predict a person’s personality traits for identifying their behavioral style and money attitudes.

Reinforce your understanding of how BeSci Tech can create a life-changing shift in the way people think, make decisions, run their businesses, and relate to others.

Get a little background on our business and take a peek at the behavioral style reports of our team members!

Got questions? We're available by phone, email, or chat to discuss any of our behavioral solutions.

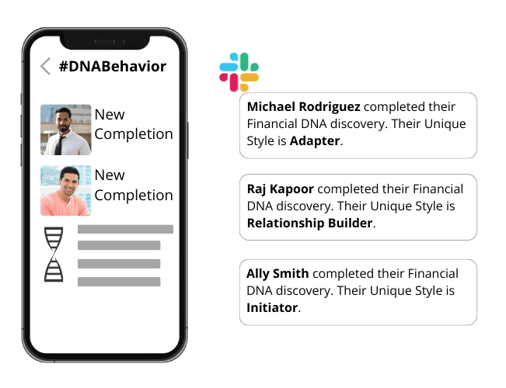

By connecting DNA Behavior with Slack, Kemp Financial Management was able to simplify processes and enrich client relationships!

The Kemp Financial Management team in Fullerton, California, is an extraordinary group of visionary leaders in wealth planning. They are committed to providing comprehensive services to a select clientele and have always sought innovative solutions to enhance client and employee experiences. This case study explores how the firm uses our BeSci technology to access behavioral insights in Slack, match advisors to clients, and more.

Tapping Into Behavioral Insights

In their quest to offer tailored wealth planning services, Kemp Financial Management utilizes DNA Behavior's financial behavior insights as the cornerstone of their client interaction strategy. This allows them to gain a comprehensive understanding of their clients even before the first meeting. Here's how they integrate insights into their process.

WATCH THE ON-DEMAND VIDEO: Connected Apps for Your Account

Assessing Financial Personality:

Risk Behavior is assessed first to understand a client's comfort with taking risks, which is crucial for investment strategies. This insight into risk tolerance enables the team to align investment recommendations with the client's comfort level.

The Financial Relationship Management insight reveals the time and energy likely required to work with each client. This understanding helps the firm allocate resources effectively, ensuring that each client receives the attention they need.

The Financial Planning Management insight helps them evaluate how organized a client is financially and whether they are naturally savers or spenders. It is instrumental in crafting financial plans that resonate with the client's natural tendencies.

The Wealth Building Motivation insight gauges clients' ability to set and ambitiously pursue financial goals, offering a window into their future financial planning needs.

Financial Emotional Intelligence is another critical area, assessing a client's ability to balance decision-making impulses. This insight helps clients maintain a balanced approach to their financial decisions.

Enhancing Advisor-Client Compatibility

A unique aspect of Kemp Financial Management’s approach is using the Style Match Insight between advisor and client. This tool measures the degree of similarity or difference in styles as a percentage, aiding in identifying the most compatible advisor-client pairs and suggesting adjustments in collaboration styles where necessary.

Communication Tailored to Individual Preferences

The firm also focuses on Communication Keys, utilizing recommendations on adjusting communication styles for the most effective interactions with each client. This becomes especially crucial when two users have low Style Match insight scores.

By harnessing these comprehensive behavioral insights, they not only enhance the client experience but also optimize internal processes, ensuring a more efficient and personalized approach to wealth management.

The Client Discovery Process

Kemp Financial Management has implemented a self-registration process for completing the DNA discovery that is also client-centric. Clients are empowered to independently set up their accounts, requiring them to input their name, email address, and a password of their choice. This streamlined approach not only simplifies the initial setup process but also grants clients greater control over their accounts. Upon the completion of this process, the firm’s compact team of five is notified through email alerts sent to a central inbox.

Technology Challenge & Solution

While DNA Behavior's native email alert system is efficient, it wasn't an ideal fit for Kemp Financial Management’s dynamic workflow, where the preference leaned towards concise alerts via Slack rather than traditional email notifications. Given the fast-paced nature of their office environment and the team's need for succinct, on-the-go communication, the firm sought an alternative to the usual email alerts. They aimed for a solution to deliver rapid and unobtrusive updates to their team members regarding new client discovery.

The answer to this challenge was an intelligent integration of DNA Behavior with Zapier and Slack. This strategic move enabled them to receive streamlined notifications directly through Slack, perfectly aligned with their fast-moving office culture and preference for brief, immediate messaging.

Zapier: The Bridge Between Slack and DNA Behavior

Zapier, known for its ability to link over 6,000+ business apps effortlessly, became the connective tissue for their workflow. Wyatt Kiedrowski, the project's champion and a “Relationship Builder” by nature, spearheaded the initiative. His goal? To ensure that every new DNA Behavior assessment didn't just sit in an email but actively informed the team's approach to client management.

Instant Alerts, Immediate Action

The implementation was straightforward, yet impactful. By creating a Zap that sent notifications to Slack whenever a DNA Behavior assessment was completed, the team was instantly informed. This not only kept them updated but also served as a reminder to prepare personalized reports and strategies for each client. The immediacy of this system allowed for faster and more tailored responses, aligning perfectly with the firm’s ethos of personalized service.

Learning and Adapting

Throughout the process, the team learned valuable lessons about data integration and the capabilities of Zapier when connected to DNA Behavior. The simplicity of the setup and the instant benefits were a testament to the power of effective digital tools in enhancing business processes.

A New Era of Client Engagement

Since implementing the Zapier and Slack integration, the firm has witnessed a significant improvement in both customer and employee experiences. Clients enjoy a more personalized approach from the get-go, and employees are better equipped to meet their needs. The integration has brought DNA Behavior's insights closer to the heart of Kemp Financial Management’s operations, enabling them to make more informed decisions and foster stronger client relationships.

Our Commitment to Innovation

At DNA Behavior, we are thrilled to see Kemp Financial Management leverage our tools in such an impactful way. Their success story is a testament to the power of integrating behavioral insights into the fabric of financial management. We are likewise committed to supporting other forward-thinking firms in their journey to provide exceptional services and deepen client relationships.

Innovation, after all, is not just about adopting new technologies; it's about transforming them into vehicles that drive meaningful engagement and growth.

When it came to building a client-centered approach to wealth management, Arete Bank turned to DNA Behavior for the human data they needed.

Maximum Impact Partners leverages the DNA Web App in their mission to develop some of the most effective sales teams in the financial services...

1 min read

About Merit Financial Advisors Merit Financial Advisors uses the DNA Web App to find the right talent, enhance team dynamics, and acquire firms that...